21 Bitcoin Adoption Facts You Probably Didn't Know

Since its inception in 2008, Bitcoin's adoption has been nothing less than meteoric. Here are 21 facts you probably didn't know.

As an investor or capital allocator, you have to be aware of the changing landscape and ensure that you're skating to where the puck is heading.

These 21 facts about Bitcoin adoption highlight the tremendous momentum Bitcoin has built in its 16 year history.

High Level Bitcoin Adoption Facts

These adoption metrics highlight the size and scale of Bitcoin as a monetary platform.

1) Bitcoin has processed over 1 billion secure transactions.

Bitcoin is explicitly designed as a secure payment processor and global digital ledger. Since inception Bitcoin has not had a single hack on the network making it the most secure monetary system humanity has ever built.

Reference: The Block Co

2) Bitcoin is the largest computer network in the world.

In order to secure those transactions, Bitcoin implements a Proof of Work system that requires computational work to be performed to secure the ledger.

With over 550 exahashes per second of computation output, the Bitcoin network is bigger than AWS, Google Cloud, and Microsoft's cloud network's combined.

Reference: Cathie Wood, Blockchain hash rate

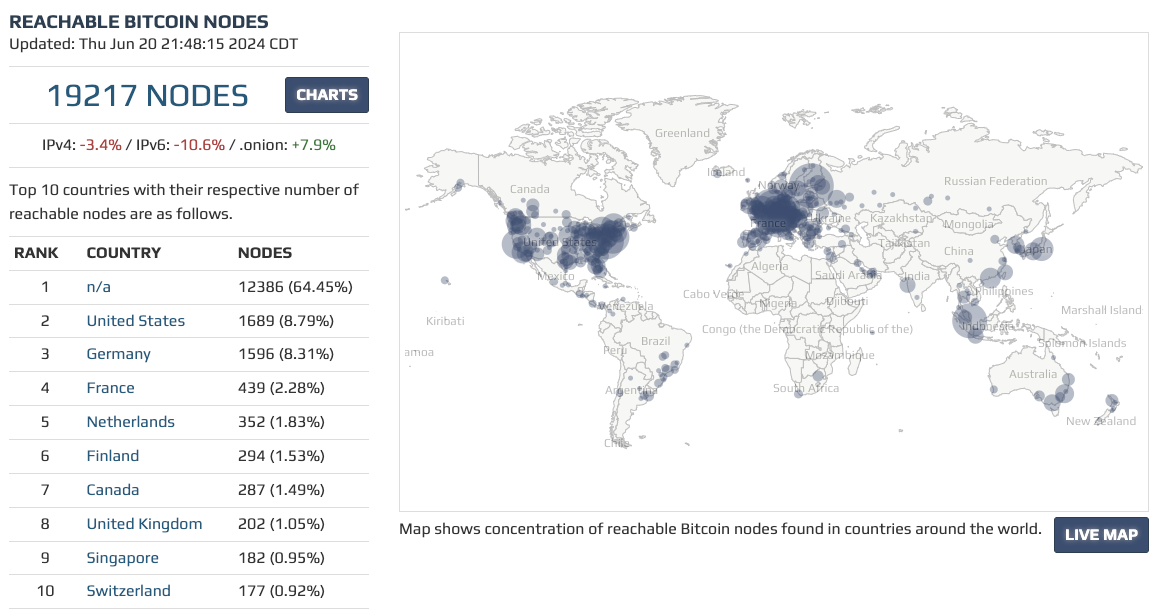

3) Bitcoin has over 19,000 nodes around the world and has been up for 100% of the time since 2014.

Individual volunteers around the world, including myself, maintain Bitcoin nodes to validate transactions and keep a copy of the bitcoin ledger.

With only 2 downtime events in 2010 and 2013, Bitcoin is the most reliable network that humanity has ever built.

Reference: Bitcoin Uptime, Bitnodes

4) Bitcoin's "market cap" is bigger than Facebook with over $1 Trillion.

As a currency, it's not really accurate to say that Bitcoin has a market cap, but at the current circulating supply of 19.72M coins and the current price over $60,000, Bitcoin has a market cap of over $1,190,000,000,000.

Imagine a company the size of Facebook going from 0 to the over $1 trillion in market cap with no CEO, no leadership, no coordination, just purely through the incentives and robustness of the network and protocol. Impressive to say the least.

Reference: Infinite Market Cap

5) Bitcoin is only at ~4.7% global adoption. We're still early.

At ~4.7% global adoption, Bitcoin is on par with internet adoption circa 2000.

Bitcoin is the only currency in the world with an effectively immutable supply, and since the halving in April of '24, it is the most scarce asset in the world.

This means that even at 4.7% global adoption, we are no where even close to the asymptotic value of Bitcoin. Combined with the facts below, there's no sign of slowing down either.

Reference: UK Investing

International Adoption Facts

In the United States, we've had the luxury of a relatively stable financial system. However, the rest of the world is a very different place and the international adoption has been fascinating to witness.

6) In 2021, El Salvador was the first country to make Bitcoin legal tender.

Before Nayib Bukele was elected in 2019, El Salvador was the murder capital of the world. It had high crime, corruption, and could not get foreign investment.

El Salvador needed to get out from under the control of the IMF and political manipulation of the USD for Bukele to execute his strategy. Bukele needed to reduce crime, increase transparency and make El Salvador attractive for outside investment. However, there were too many hands in the cookie jar for previous leadership to make the needed changes.

With Bukele's adoption of Bitcoin as legal tender for El Salvador, they were able to finally act independently. This allowed Bukele and the new government to truly crack down on the gangs, fight corruption, and re-invest in their country.

Since then El Salvador, has become the safest country in Latin America. The freedom to act autonomously with Bitcoin gave El Salvador the capability to liberate themselves and create a model for future governments.

Reference: Reuters

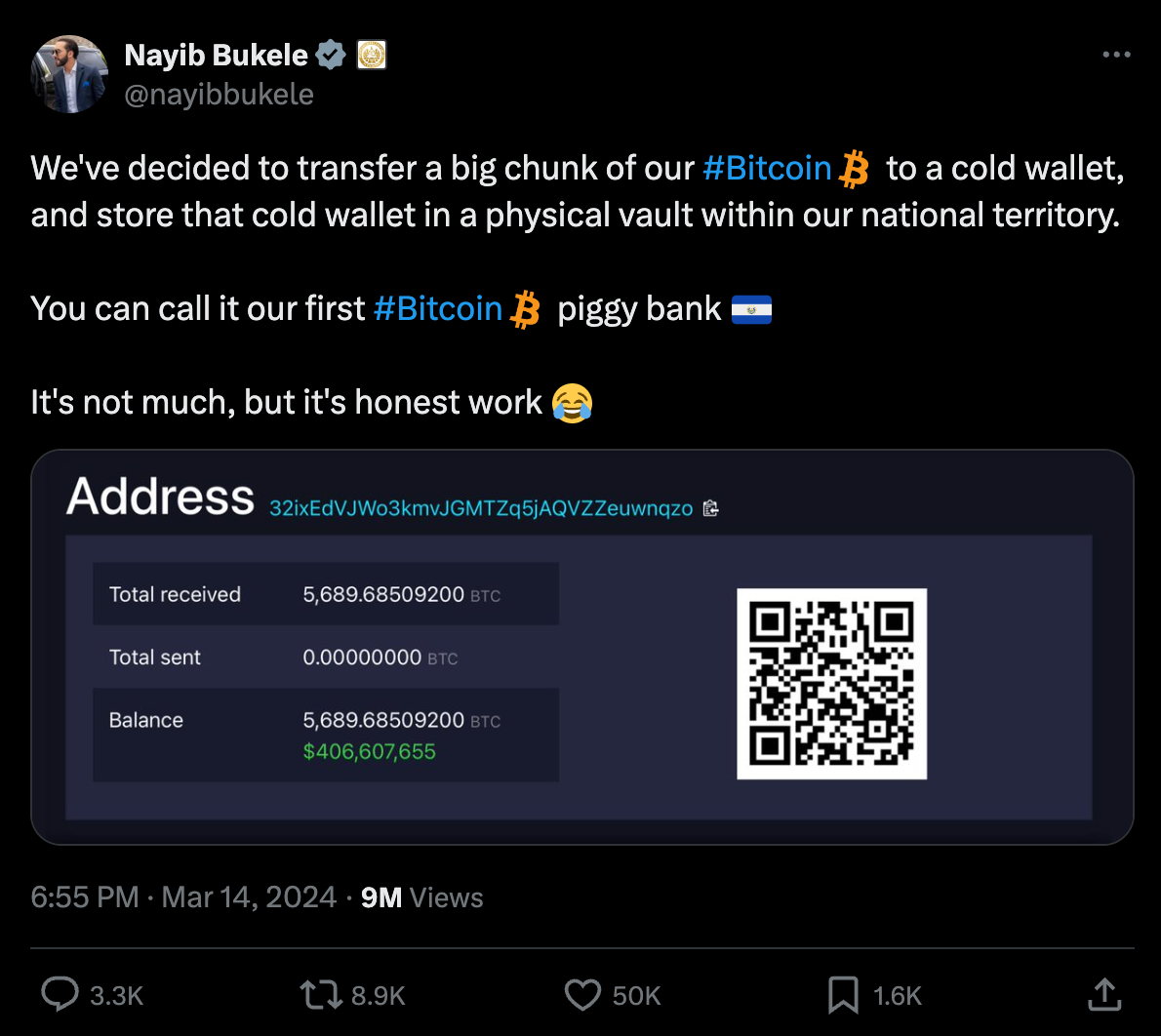

7) El Salvador has over $370M in Bitcoin, and you can view their Bitcoin address yourself.

Since adopting Bitcoin as legal tender, El Salvador has bought 1 Bitcoin per day and has made their holdings publicly verifiable.

In a truly unprecedented move, Nayib Bukele decided that the right way to bolster transparency was to make their purchases and their Bitcoin piggy bank public. This builds trust in the El Salvadorian government and sets a permanent precedent for future leaders to emulate, should they want transparency in their government.

You can see the balance on the blockchain for yourself at mempool.space.

Reference: Nayib Bukele

8) In Peru, there are at least 4 rural communities that run entirely on Bitcoin.

In wonderful documentary by Julian Figueroa, he documented how Bitcoin has transformed parts of rural Peru through a secure digital economy that everyone can trust.

Peru, and much of South America has been decimated by corrupt politicians, hyper inflation, and bad government decisions.

For these communities, Bitcoin has served as an escape hatch to their eroding purchasing power and freedom to save, plan, and invest in their community.

Reference: Julian Figueroa

9) In Nigeria, over 70M people own Bitcoin.

Over in Africa, over 35% of Nigeria's 200M own Bitcoin. Nigeria’s inflation rate rose to 29.90% in January 2024 and does not show signs of slowing down.

Because of this, Nigeria has one of the highest Bitcoin adoption rates of any country in the world.

Reference: Invezz Research, The Conversation

10) The Kingdom of Bhutan has been mining Bitcoin since 2019. The price of Bitcoin was ~$5,000.

As a way to leverage it's massive hydroelectric power generation, the Kingdom of Bhutan began mining Bitcoin.

While its operations are generally small compared to large scale operations in Texas or other nations, the Kingdom has used their hydropower and pro-bitcoin stance to draw additional investment into the country.

Fun note: The Kingdom of Bhutan is one of the only countries in the world that measures "Gross National Happiness" over "Gross Domestic Product".

Reference: Forbes

11) Argentinian investors are working with Texas based Giga Energy to mine Bitcoin with flared natural gas.

Argentina's energy mix is dominated by natural gas ( 55% ) and has the 2nd largest shale natural gas reserve in the world.

As a by-product from oil and gas production, sometimes unusable or uncapturable natural gas is flared off. Converting the flared natural gas to electricity on site allows the energy producers the ability to reduce carbon emissions and make money from mining Bitcoin.

Texas based Giga Energy has been mining Bitcoin with flared natural gas since 2018 and was a perfect fit to help Argentine producers with their issue.

Reference: Coin Telegraph, IEA.org

12) As of 2022, Kazakhstan is the 3rd largest producer of hashrate.

Kzakstan produces ~13% of all the hashrate in the world. China is #2 and produces upwards of 21% of the hashrate. The US is #1 at 37% .

Surprisingly, Kazakstan has one of the lowest energy costs in the world, making it a hot spot for Bitcoin mining operations.

Reference: Statista

13) In 2024, Paco de la India traveled across 40 countries using only Bitcoin.

In a fantastic story of community and culture, Paco was able to document his experience on his YouTube channel and social media profiles about his travels meeting other Bitcoiners all while using only Bitcoin.

He was able to use Bitcoin exclusively in countries such as Kenya, Papa New Guinea, Indonesia, and more...

Reference: Paco de la India

Domestic & Institutional Adoption Facts

Bringing the adoption facts back to the United States, Bitcoin is equally as prevalent and strong.

14) In the United States, over 34M people own Bitcoin.

In the United States, ~15% of the population or ~50M people own cryptocurrency, and in the Finder Crypto Adoption survey, 68% of crypto owners held Bitcoin.

This is predominantly concentrated in the younger demographics with Gen Y and Gen Z being the highest percentage of Bitcoin holders.

Reference: Finder.com

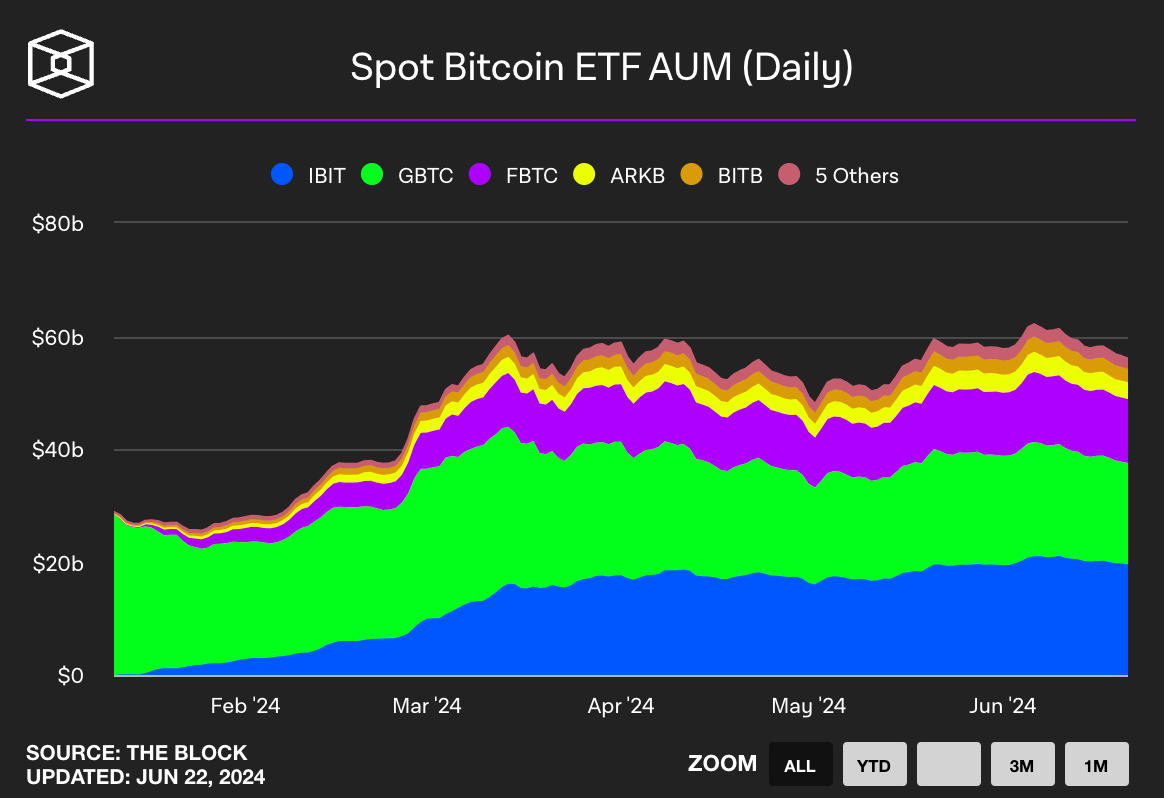

15) The recent US Bitcoin ETFs have accrued over $50B in AUM in less than 6 months.

As of this writing, the Bitcoin ETFs have collectively seen the most rapid accumulation of capital from public investors ever.

Within 45 days of the opening of the ETFs, the price of Bitcoin more than doubled from the initial wave of institutional investors access to Bitcoin.

Reference: The Block

16) 69% of Institutions polled by EY expect to increase their Bitcoin holdings in the next 2 - 3 years.

Institutions are desperately looking for new ways to generate returns for their clients amidst the inflation, interest rates, and regulatory environment.

In the EY poll, more than 35% suggested they would make between 1 - 5% allocations over the next few years and are taking a categorically long position on those investments.

The institutions polled represent trillions of dollars of capital.

Reference: EY

17) The Wisconsin Pension Fund has committed $162M to Bitcoin purchases.

Through the ETFs, Wisconsin's state pension fund was the first of its kind to publicly commit to buying Bitcoin.

$162M is less than 1% of the fund's total assets under management (AUM), but the move is still historic as pension fund's typically do not invest in nascent ETFs, especially ones where the underlying asset is also equally new.

This goes to show the value proposition of Bitcoin for long term investors.

Reference: WPR.org

18) In 2024, The State of Oklahoma signed into law a bill that legally protects Bitcoin, self-custody, spending, mining, and more within the State.

In the United States, as per the 10th Amendment to the Constitution, all powers not delegated to the federal government are reserved to the states.

Interestingly though, the Supreme Court in Houston v. Moore (1820) recognized Congress' coinage power to be exclusive, as per Article I, Section 8, Clause 5.

I'm not an attorney, but Bitcoin is not controlled by anyone, so I could see Oklahoma's move to be both an exercise in Oklahoma's states rights and a huge signal that Oklahoma will fight the legal battle should the federal government decide they don't like Bitcoin.

🚨HUGELY MASSIVE BRREAKING🚨: A bill protecting your ‘fundamental #Bitcoin rights’ has been SIGNED INTO LAW in the state of Oklahoma.

— Dennis Porter (@Dennis_Porter_) May 14, 2024

Oklahoma will now defend your:

✅ Right to self-custody

✅ Right to spend #Bitcoin and digital assets

✅ Right to mine #Bitcoin

✅ Right to run… pic.twitter.com/KdPsmLBzDo

Reference: Bill Track 50, Dennis Porter, Blockworks

19) Over 100,000 merchants accept Bitcoin including Microsoft, Expedia, & Twitch.

These companies may accept Bitcoin through 3rd party integrations like BitPay or with custom built integrations, but none the less, there is a huge swath of merchants that are capable to take Bitcoin as payment today.

These companies may not be running their accounting books on Bitcoin, but there's a non-zero probability that could change.

Reference: IBTimes

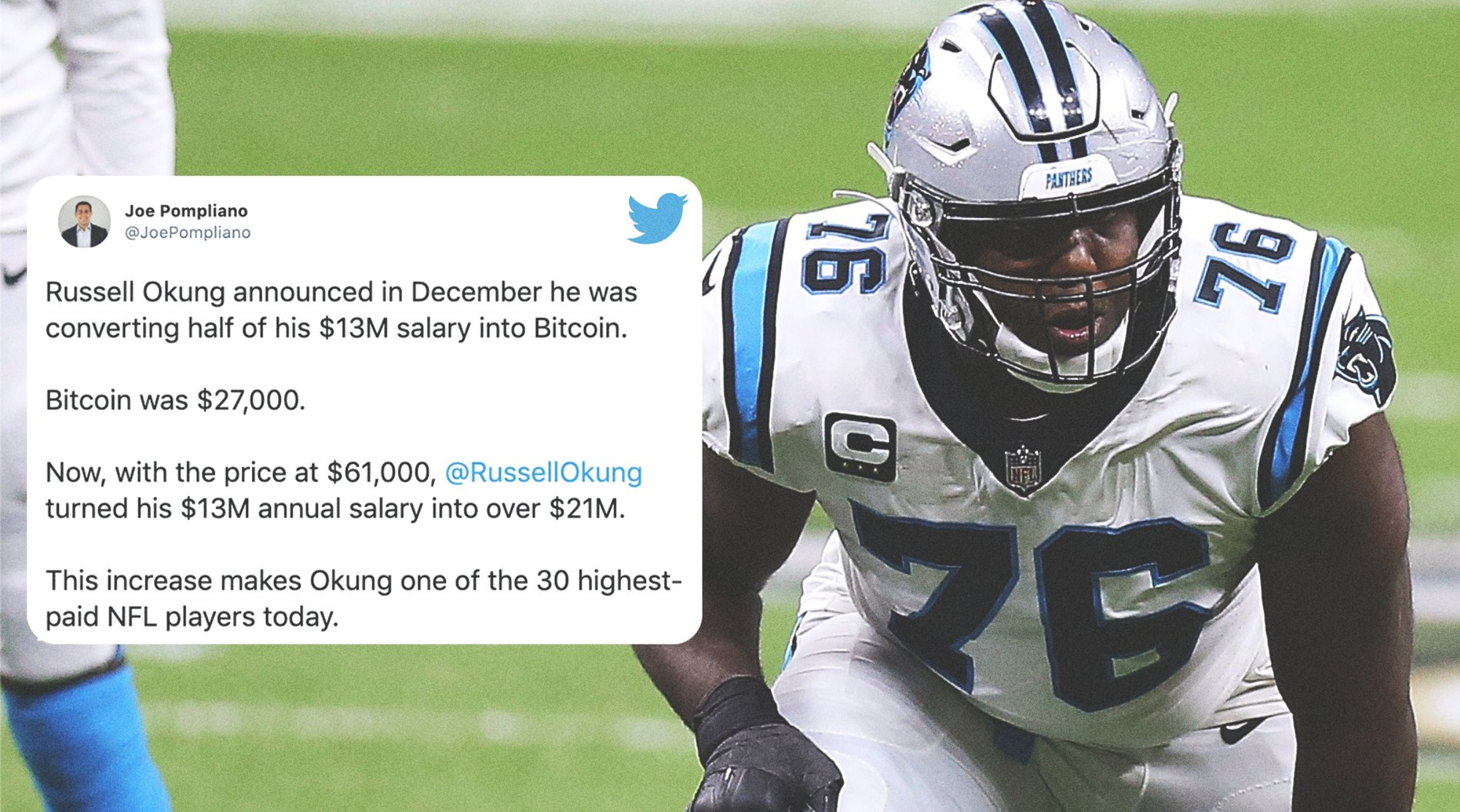

20) In 2020, The Carolina Panthers paid 1/2 of NFL Russell Okung's $13M salary in Bitcoin.

This made Russell Okung the first NFL player to be paid in Bitcoin.

Since then, there have been many other professional athletes to take payment in Bitcoin, marking a distinctive trend for high net worth players to demand payment in alternative forms of currency.

Reference: BNN Bloomberg, ESPN

21) US based MicroStrategy holds >1% of all Bitcoin that will ever exist.

MicroStrategy ( MSTR ), under the leadership of CEO Michael Saylor, has been buying Bitcoin since 2019 and has amassed over 220,000 Bitcoin in that time.

Given that Bitcoin is fixed at a supply cap of no more than 21M Bitcoin, this puts their holdings over 1% of the total Bitcoin that will ever exist.

Michael Saylor concludes, and I conclude as well, that Bitcoin is the best engineered money and will become the single global mechanism for storing and transferring value.

Since MicroStrategy has adopted their Bitcoin strategy, their stock is up 346% and are on track to enter the S&P 500.

Michael Saylors

Reference: CoinDesk, Coinpedia

Study Bitcoin

If these facts at all surprised you or piqued your curiosity, I strongly recommend taking the time to study Bitcoin.

Bitcoin is a monetary asset, a network protocol, a store of value, a medium of exchange, a digital ledger, a hedge against inflation, an alternative to fiat currencies, and much more.

I recommend starting with the fundamentals to get the best understanding:

- Introduction to Bitcoin: what is bitcoin and why does it matter?

- But how does bitcoin actually work?

- Explore the content on Hope.com

Township Ventures is a long term holding company that buys and builds Texas businesses to last generations.

If you're curious to learn more about how we buy businesses or opportunities to participate, don't hesitate to reach out.

Stay humble. Stack sats.